GBP/USD: negative dynamics prevails

22/05/2018

Current dynamics

As the head of the Bank of England, Mark Carney, stated today, "the signs of the restoration of momentum can be manifested in the next few months". "If the momentum recovers, then, according to our guidelines, certain actions will follow logically", added Carney. In the meantime, Mark Carney suggests waiting for "recovery of momentum before raising the stakes".

Another representative of the Bank of England Vlige spoke in the same vein, saying that "we can wait for a few more months without special expenses before raising rates".

As you know, earlier in the month the Bank of England retained the key interest rate at 0.50%. In the face of continuing uncertainties regarding Brexit, as well as against the backdrop of the absence of "signs of recovery of momentum", the Bank of England preferred not to change the current conditions of monetary policy. Although the collapse of the British economy after the referendum on Brexit in the summer of 2016 did not happen, the collapse of the pound and the subsequent rapid growth of inflation significantly worsened the level of welfare of the British. The fall in the level of retail sales and domestic demand had a negative impact on the UK economy, focused primarily on the domestic market.

The tightening of the monetary policy of the central bank would have a stimulating effect on the growth of consumer spending, especially with regard to imported goods.

However, the increase in the interest rate makes higher interest rates on loans for commercial banks and for the population, including mortgage loans. A higher exchange rate of the national currency also reduces the competitiveness of export products abroad, which negatively affects the country's exporters. The deficit of the UK trade balance exceeds 3 billion pounds and has a tendency to increase. The Bank of England also lowered its forecast for GDP for 2018 from 1.75% to 1.40%.

On Wednesday (08:30 GMT) data on consumer inflation in the UK will be published. As expected, the consumer price index (CPI) will indicate that the growth rate of annual inflation in April did not change (2.5% against 2.5% in March).

If the data does indicate an acceleration of inflation, the Bank of England will be forced to tighten monetary policy. Some economists expect that the Bank of England can still go on raising rates in August or November, which will cause the strengthening of the pound.

Meanwhile, representatives of the Federal Reserve regularly give signals about the commitment of the US central bank to a plan to further tighten monetary policy.

So, on Tuesday, a member of the Committee on open market operations, the FRS Patrick Harker said that he will support three more increases in the key rate this year. It is characteristic that even last month Harker was among those who spoke of "two more rises".

According to another member of the FOMC, Loretta Mester, "it is advisable to continue tightening monetary policy to avoid increasing risks to macroeconomic stability".

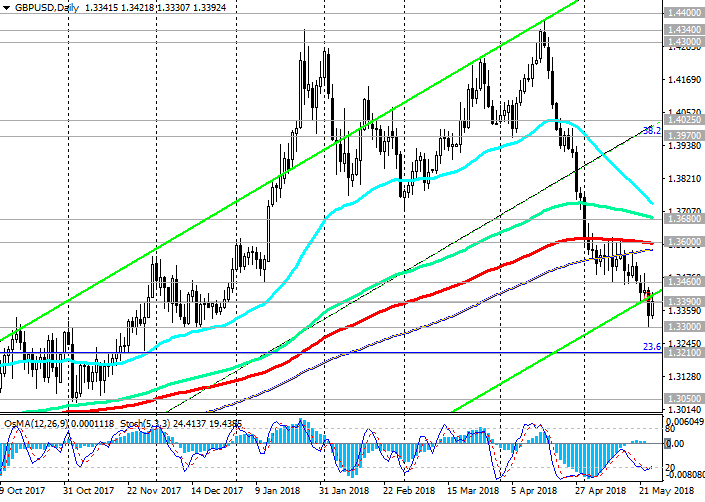

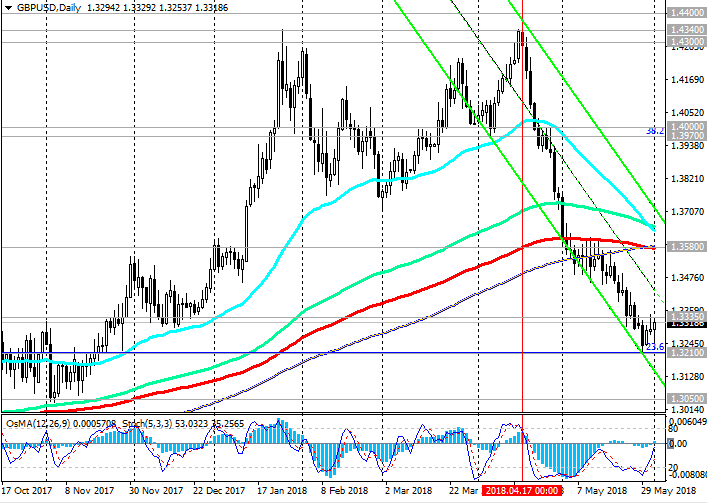

Thus, the Bank of England's predilection for a softer monetary policy amid the Federal Reserve's intention to gradually raise the interest rate makes the pound vulnerable to the dollar and leads to a further decline in the GBP / USD.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

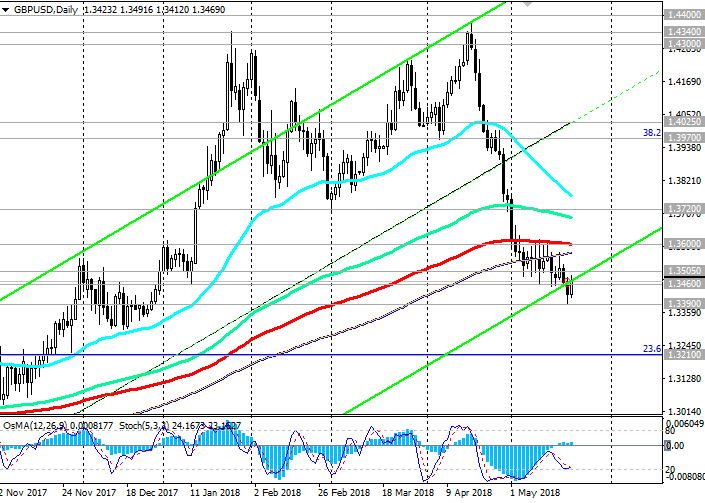

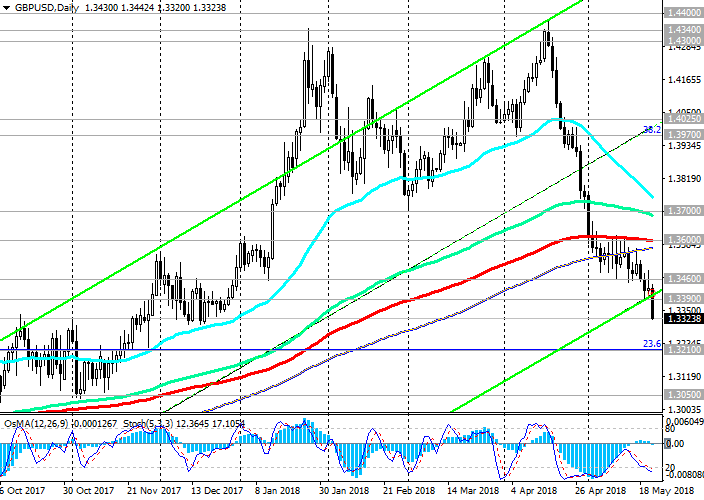

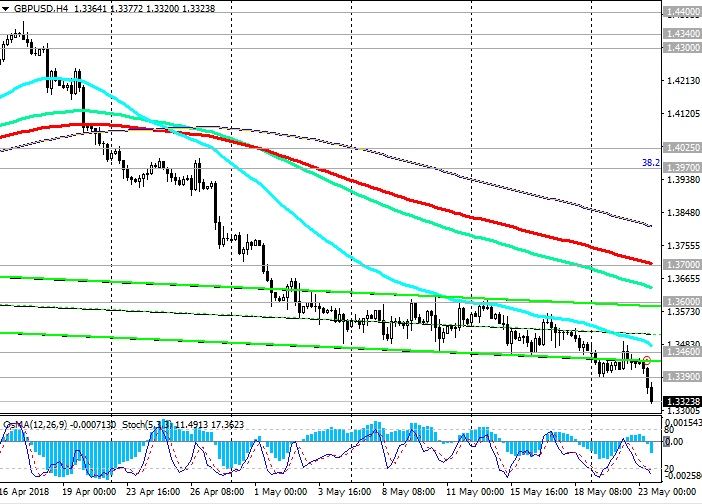

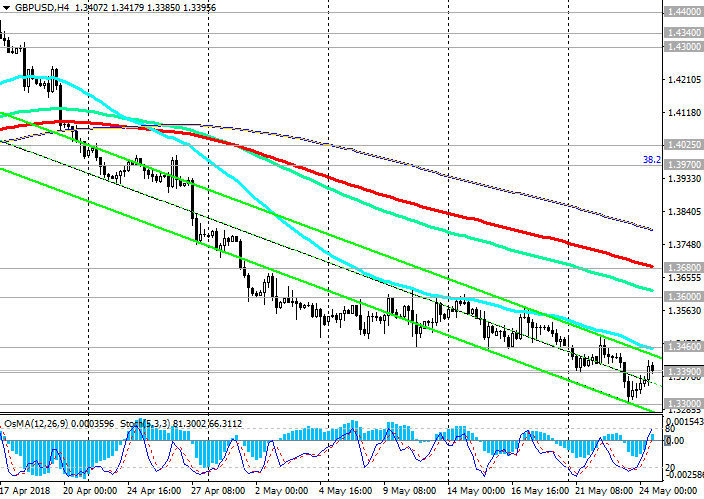

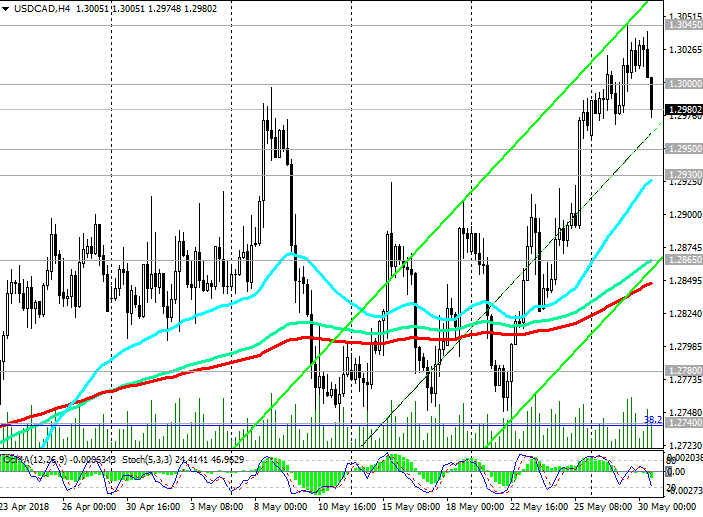

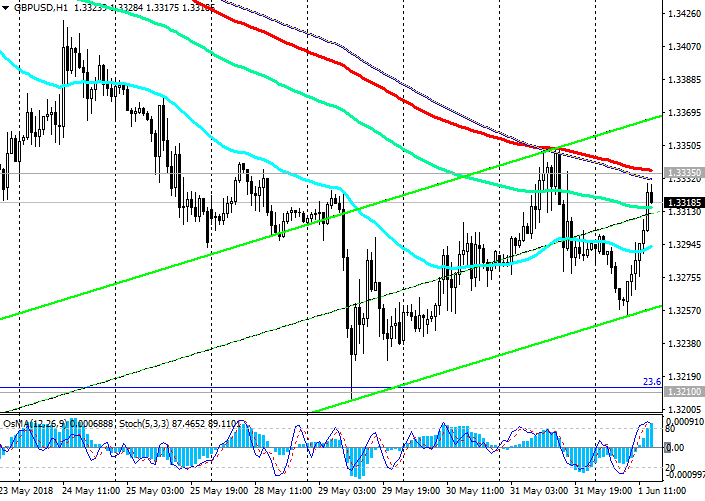

Support levels: 1.3460, 1.3390, 1.3300, 1.3210

Resistance levels: 1.3505, 1.3600, 1.3720, 1.3800, 1.3970, 1.4025

Trading Scenarios

Sell in the market. Stop-Loss 1.3530. Take-Profit 1.3460, 1.3390, 1.3300, 1.3210

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks