AUD/USD: negative dynamics

21/04/2020

"The double blow to health care and the economy that led to the emergency we are experiencing now will cast a shadow over our economy for a long time", said Reserve Bank of Australia manager Philip Lowe on Tuesday. According to him, the country's GDP in the first half of the year will decrease by 10%, and unemployment will rise to 10% - a level that the country has not seen since the beginning of the 1990s.

Philip Lowe began his speech shortly after the minutes were published from the April meeting of the RBA.

As you know, in early April, the next regular meeting of the RBA was held, following which the bank management decided to keep the current monetary policy unchanged. The key interest rate of the RBA was previously lowered to a record low of 0.25%, and the target rate of return for 3-year government bonds was down to 0.25% in order to support businesses and Australian citizens amid the rapid spread of the coronavirus pandemic.

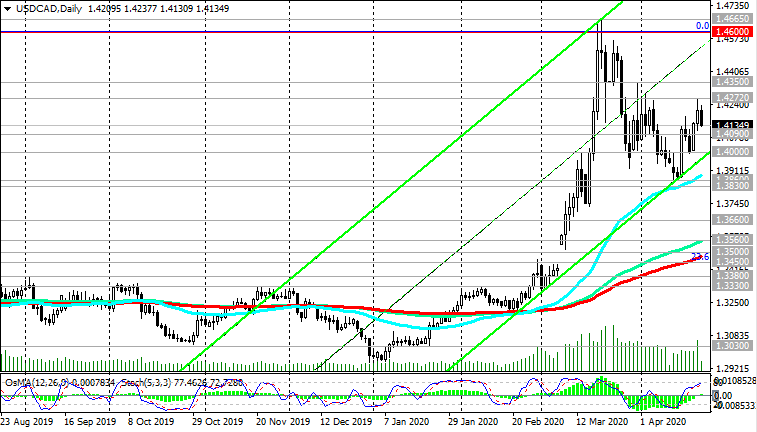

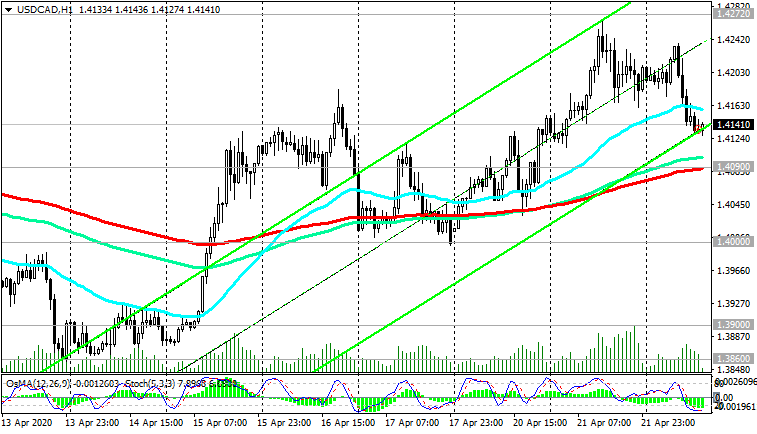

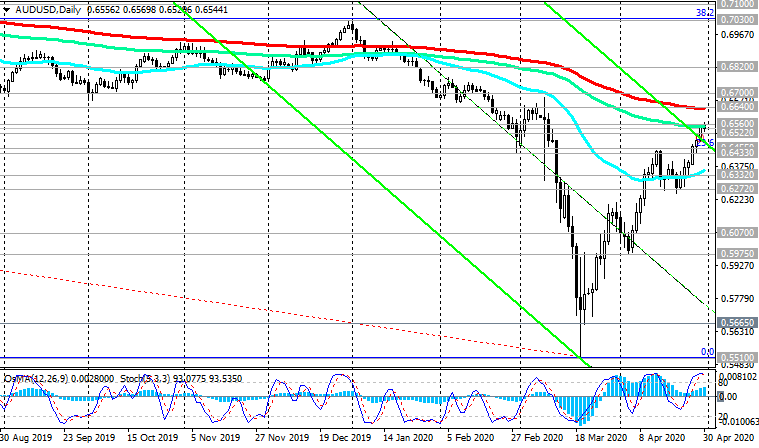

After the performance of Philip Lowe and amid a landslide drop in oil prices and world stock indices, the Australian dollar is weakening today along with other commodity currencies.

At the same time, the US dollar continues to dominate the financial markets amid investors fleeing risk, acting as a protective asset.

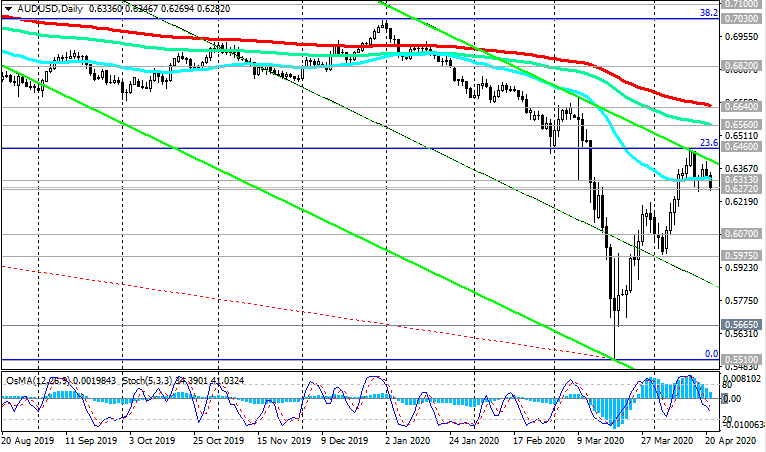

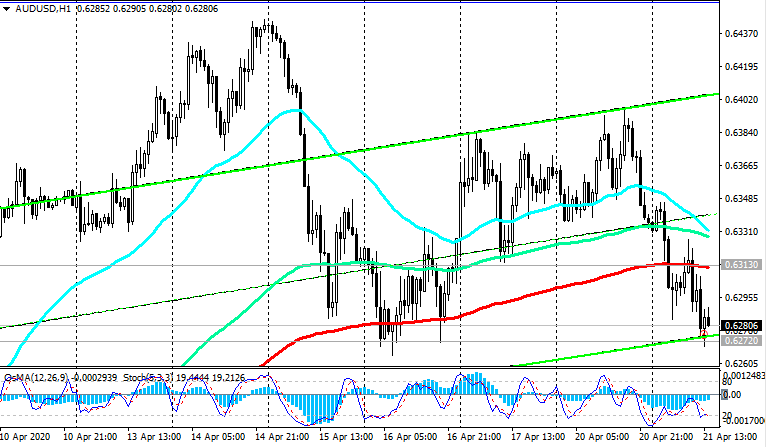

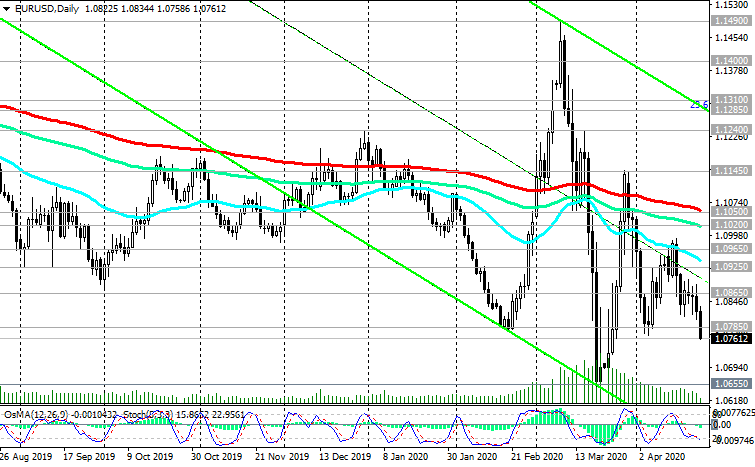

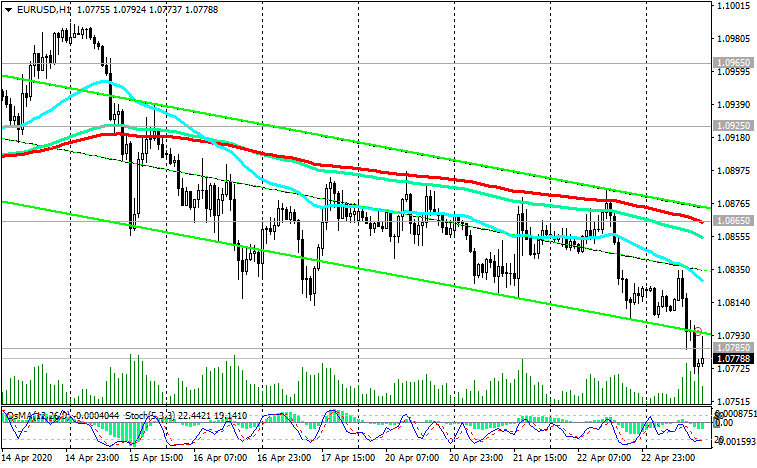

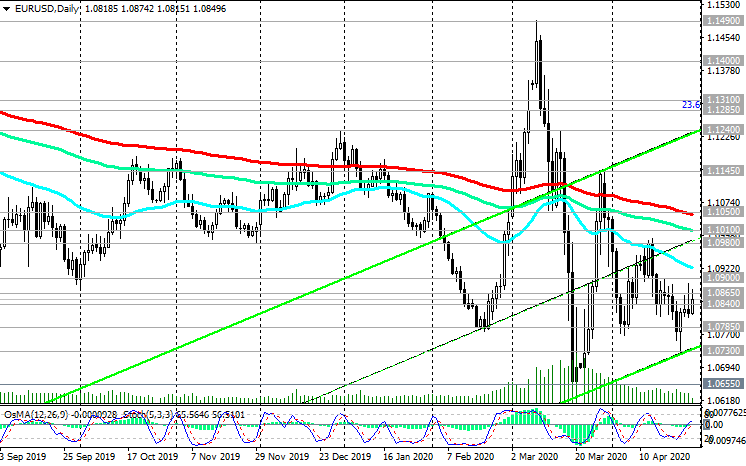

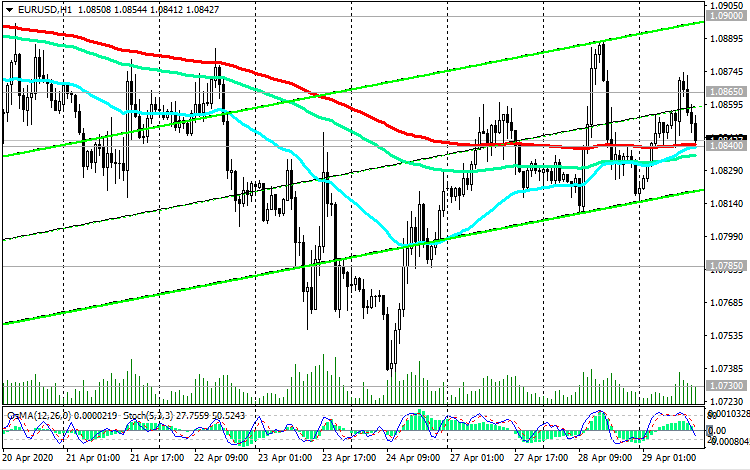

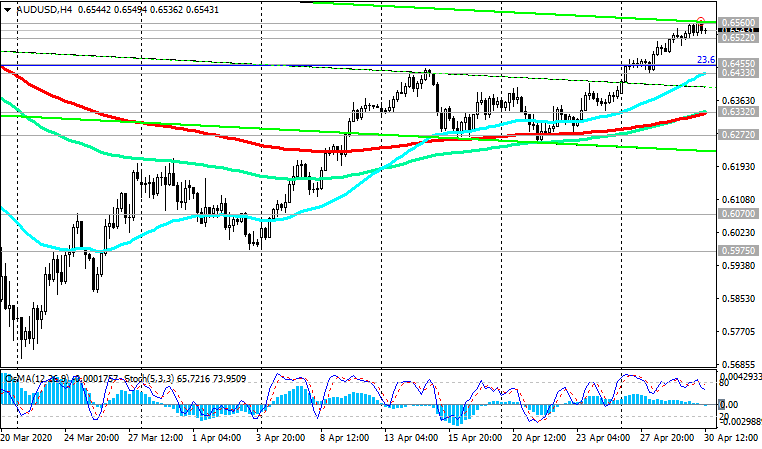

On Tuesday, AUD / USD broke through the important short-term support level of 0.6313 (EMA200 on the 1-hour chart, EMA50 on the daily chart) and is developing a downward trend in the direction of support level 0.6272 (EMA200 on the 4-hour chart). A breakdown of this support level will increase the likelihood of a further decline in the pair and again make short positions relevant with targets at local support levels of 0.5975, 0.5665, 0.5510.

Below the resistance level of 0.6640 (ЕМА200 on the daily chart), the long-term negative dynamics of AUD / USD prevails. For now, only short positions should be considered.

Support Levels: 0.6272, 0.6070, 0.5975, 0.5665, 0.5510

Resistance Levels: 0.6313, 0.6460, 0.6560, 0.6640

Trading Recommendations

Sell Stop 0.6260. Stop-Loss 0.6350. Take-Profit 0.6100, 0.6070, 0.5975, 0.5665, 0.5510

Buy Stop 0.6350. Stop-Loss 0.6260. Take-Profit 0.6400, 0.6460, 0.6560, 0.6640

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks