EUR/USD: ambiguous trading

Current trend

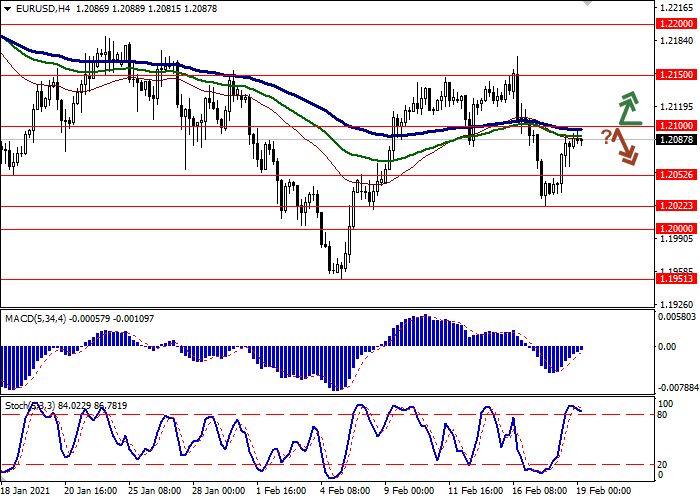

EUR is showing ambiguous trading during today's Asian session, consolidating near 1.2100 after the instrument retraced the day before. The reason for yesterday's resumption of "bullish" trend was the disappointing data from the US. Initial Jobless Claims for the week ending February 12 again showed an increase from 848K to 861K, while analysts expected their reduction to 765K. Continuing Jobless Claims for the week ending February 5 fell from 4.558M to 4.494M, which fell short of the most optimistic forecasts of 4.413M. Thus, investors are again convinced that it is still somewhat premature to talk about the beginning of a confident recovery of the American economy. As Jerome Powell said, it will take years for the labor market to return to its previous levels.

The focus of European investors today is statistics on business activity in the manufacturing and services sectors in Germany and the eurozone for February.

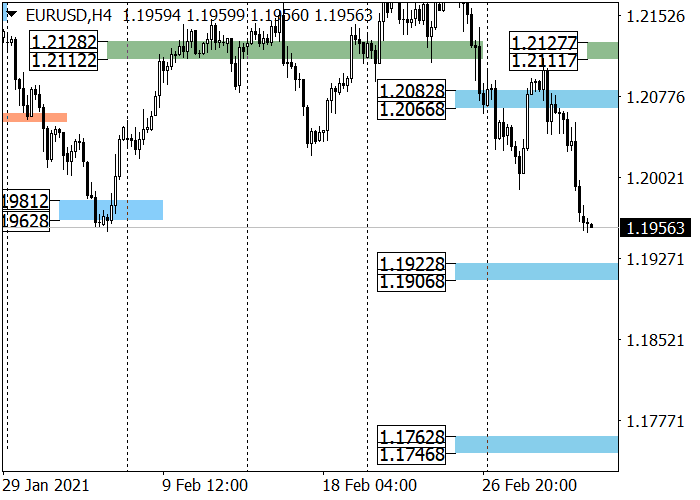

Support and resistance

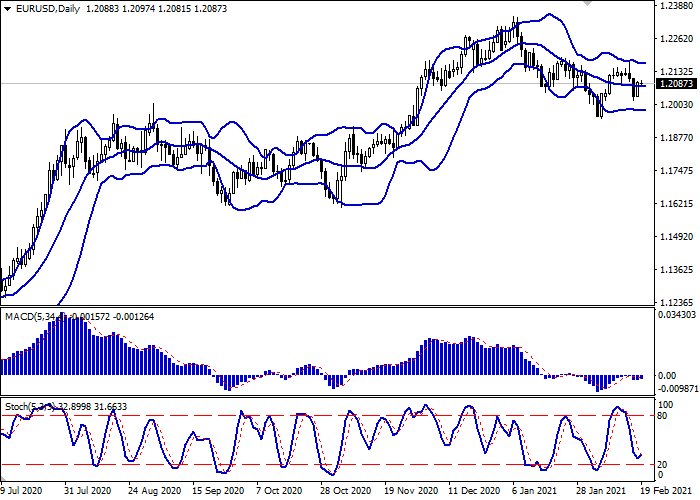

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is changing slightly, but remains rather spacious for the current level of activity in the market. MACD has reversed towards growth without forming a buy signal (located below the signal line). Stochastic shows similar dynamics, reversing upwards near the level of "20". Current readings of the indicator signal in favor of a corrective growth in the ultra-short term.

Resistance levels: 1.2100, 1.2150, 1.2200.

Support levels: 1.2052, 1.2022, 1.2000, 1.1951.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks