XAU/USD: gold quotes are correcting

Current trend

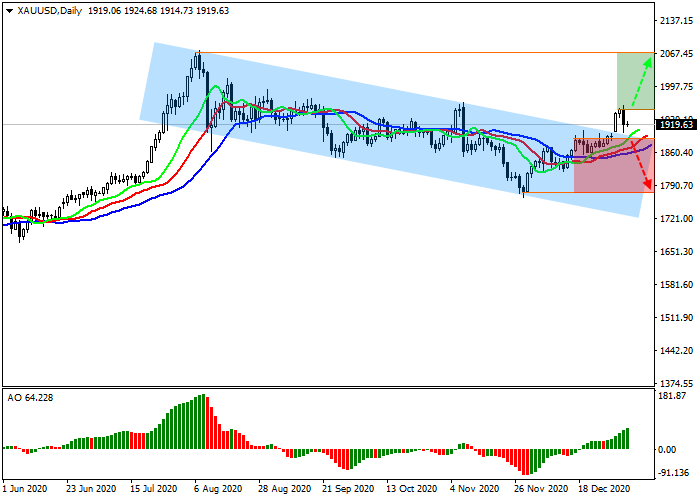

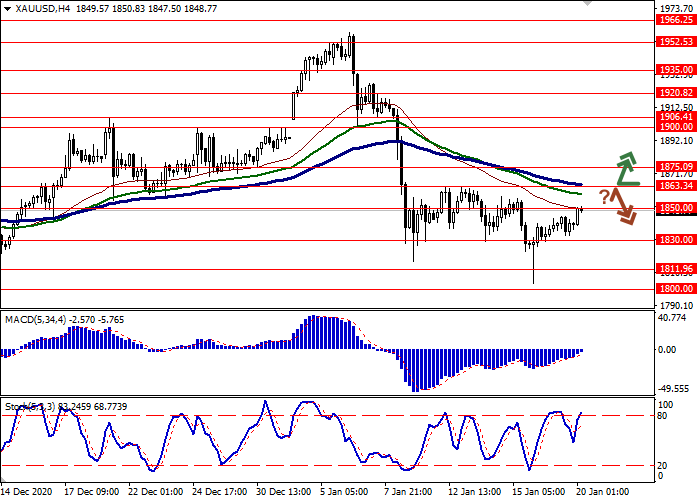

Gold quotes are consolidating around 1919.00.

As expected by most experts, the price of the precious metal has shown significant growth since the beginning of the year, and despite yesterday's decline, it remains fairly high. Undoubtedly, the strengthening of quotes is directly related to the situation around the coronavirus pandemic: the recent introduction of additional restrictions in a number of countries have pushed investors to avert risk and seek "safe havens".

However, the transition to gold was not that significant. Since mid-December, the precious metal has a new competitor, Bitcoin. It was cryptocurrency that some institutional investors began to consider as a more reliable means of fighting inflation. Bitcoin is growing, and not only preserves assets but also brings very high profitability, which makes some investors, who have always kept their funds in gold, to make a short-term choice in favor of cryptocurrency.

Support and resistance

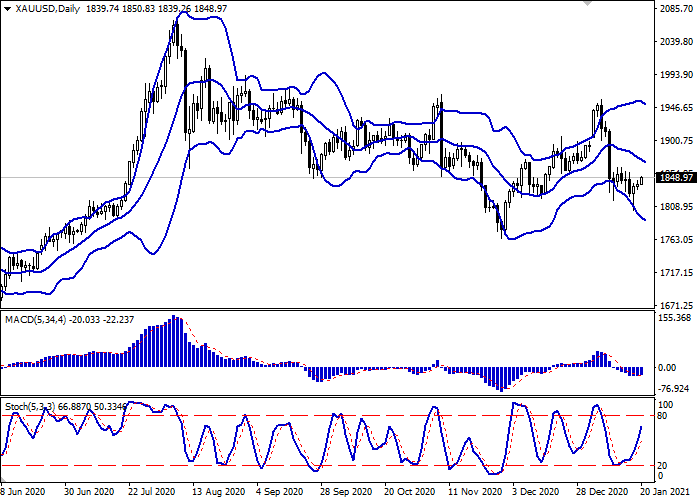

Quotes, which left the global descending channel yesterday, attempted to test the resistance line, after which growth may continue. Technical indicators continue to show a buy signal. Fast EMAs on the Alligator indicator are higher than the signal line, and the AO oscillator histogram is trading in the positive zone.

Resistance levels: 1951.0, 2067.0

Support levels: 1886.0, 1774.0.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks